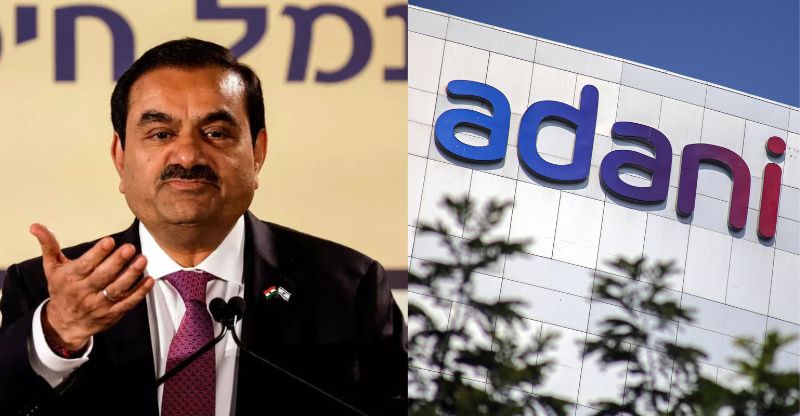

The Adani Group, led by Indian billionaire Gautam Adani, has been at the center of controversy for the past year, facing accusations of financial misconduct and unethical practices. In January 2023, U.S.-based Hindenburg Research published a scathing report accusing the conglomerate of stock manipulation, accounting fraud, and other irregularities over decades. This report led to a massive sell-off of Adani Group stocks, wiping out billions of dollars in market value. Despite the company’s denial of the allegations, it sparked investigations and raised concerns about corporate governance in one of India’s largest business empires.

Fast forward to November 2024, the situation has escalated further with U.S. federal prosecutors filing charges against Gautam Adani and seven senior executives of the Adani Group. The charges allege that the group paid over $250 million in bribes to Indian officials between 2020 and 2024 to secure favorable terms for solar energy contracts. This is a significant development as it not only highlights alleged corruption but also implicates the group in international violations, raising questions about transparency and accountability in its operations.

The indictment states that these payments were part of a systematic effort to influence policymakers and ensure advantageous conditions for the group’s solar energy ventures, a key area of its business. This has added another layer of complexity to the ongoing investigations, as it involves multiple jurisdictions and regulatory bodies. The Adani Group, in response, has strongly denied the charges, labeling them as baseless and politically motivated.

This case has not only affected the group’s financial standing but also its reputation. The controversy has shaken investor confidence, with several institutional investors reconsidering their stakes in Adani’s companies. Despite these challenges, the group continues to operate, emphasizing its commitment to renewable energy and infrastructure projects. However, the mounting legal pressures and scrutiny from international authorities pose significant hurdles for the conglomerate.

Experts believe this case could have far-reaching implications, not just for the Adani Group but for India’s corporate landscape as a whole. It has reignited debates about regulatory oversight and corporate governance in emerging markets. As investigations continue and the legal proceedings unfold, the world watches closely, considering the broader ramifications for international business practices and the integrity of large-scale corporate operations.

The latest charges mark a critical juncture in the Adani Group’s ongoing legal battle, intensifying the spotlight on its operations and leadership. The case underscores the importance of ethical business practices and robust governance, both in India and globally, as the group fights to restore its reputation.